Investment properties are on the rise. Purchasing property in a thriving real estate market like Kelowna can make for a great investment and a passive income stream. However, it may not be as straightforward as home-flipping TV shows would have you believe. With a bit of planning, preparation, and a great realtor, you can find the investment property of your dreams without the added headaches.

As the demand for real estate and property prices continues to rise in the Okanagan, it may feel like your time to buy is fleeting. But before you dive into your first or next investment property, there are some important factors to consider. Here are our top 7 things to consider when investing in a Kelowna rental property:

1. Location

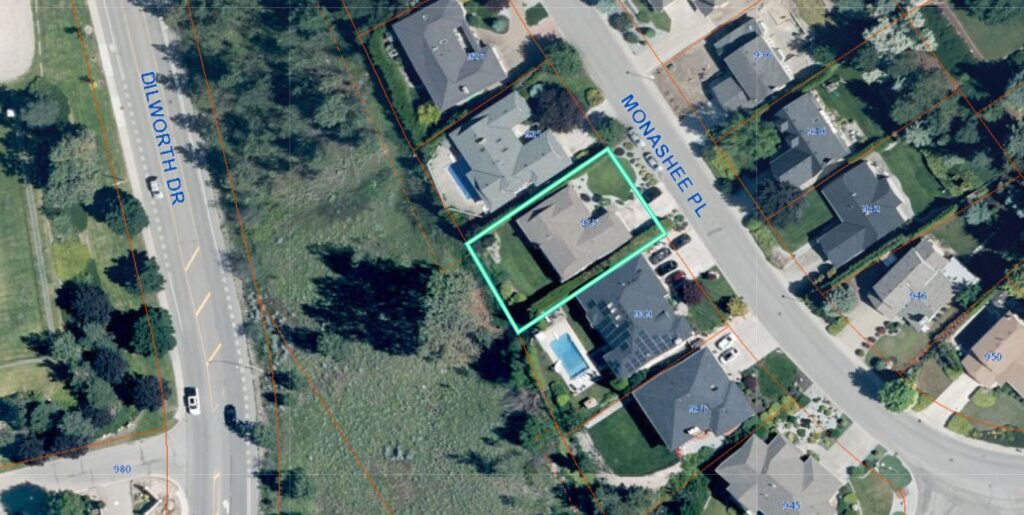

Arguably the most important factor for any piece of real estate, the location you purchase in will greatly influence the opportunities for your rental property. This will play a part in determining the cost of upkeep, turnover, and so on. Before looking at rental properties for sale, be sure to get a good understanding of the city. Knowing the neighbourhood can help you determine whether the property is a good fit for your investment goals.

If you’re from out of town, you don’t have to do this alone. Domeij & Associates has been helping clients invest in Okanagan property for years. With three generations of experience serving Kelowna and the surrounding area, we can help you find the ideal location to invest in.

2. Rental Type

Consider whether you prefer long-term rental options like student rentals and full-time tenants, or short-term options such as Airbnb and VRBO. While the former is typically seen as a better avenue for passive income, property managers for vacation rentals are becoming increasingly abundant. They can greatly ease the stress of managing short-term rentals, and allow you to capitalize on increased demand during peak tourist seasons.

3. Property Type

Condos, townhomes, and single-family homes all come with their pros and cons. While condos and townhomes typically require the least amount of maintenance, there are strata fees to consider. The strata of each particular building will also dictate whether you’ll be able to rent it out and, if so, what type of rentals are allowed. You’ll be required to pay into and respect the strata rules, which can limit your rental options.

Even without strata fees, single-family homes remain the most expensive option in terms of maintenance, upkeep, and insurance. However, these properties tend to be better prospects for future returns. They typically provide a greater opportunity for building equity into the property via major renovations and home expansions.

Note: not all strata groups allow rentals, so be sure to read the strata laws before making any purchases.

4. Property Management

Property managers will help you vet prospective tenants, take care of maintenance, and understand your legal rights as a landlord. A good property manager saves you time and gives you peace of mind if you’re located out of town, while working to maximize your profits. To determine if property management is right for you, you’ll need to consider the costs and control you’ll be giving up to employ a property manager, against the amount of work involved with being a landlord.

5. The 1% Rule

While profits will vary by location and demand, you can minimize the financial risk in your investment by utilizing this valuable rule. The 1% Rule states that rent should equal 1% of the purchase price to ensure you can cover your monthly expenses and generate a positive cash flow. Before buying any property, utilizing this rule can be helpful in assessing profitability.

6. Unexpected Events

Unfortunately, you can’t prepare for everything. Since 2019, we’ve seen unprecedented times create considerable and unavoidable risks for landlords. To prepare for the unexpected, be sure to familiarize yourself with the local and national risks associated with the type of property you are considering.

7. Financial Goals

You want to make money, of course. But it’s critical to contemplate how you want to make that money. Whether you’re looking to earn a flexible monthly income or anticipating a large lump sum payout when you sell, your choice in properties and strategies could vary greatly.

Investing with Domeij & Associates

Starting your hunt for an investment property in Kelowna can feel daunting, but it doesn’t need to be. Getting help in the buying process can help put your mind at ease and allow you to start generating a profit more quickly. Having the right advice upfront can save you money in the long run.

Domeij & Associates is a team of luxury real estate experts that specialize in Okanagan properties. With our local expertise and experience, we will help you navigate this competitive market.

Call us today to learn more about how we can help you in the buying process.